The video gaming industry is unquestionably one of the most significant and forward-thinking sectors deploying new technology and innovation. Interestingly, the gaming industry has seen considerable growth over the past years and has outperformed even the Box-Office ($42.5b) and Music ($20.2b) combined last year to emerge as the most prominent form of entertainment. Analysts predict gaming to generate more than $260 billion in revenue by 2025, and no surprises why technology giants Google, Facebook, and Apple have made plans to enter the gaming industry.

INTERESTING FACTS

- About half a billion people played the game 'Among Us,' which is 2.5 times the number of Netflix subscribers.

- The Global Esports industry is growing at the rate of 30% year-over-year.

- There are over 2.2 billion mobile gamers

- Revenue from Free to Play games amounts to over 85% of all game revenue.

- The PC gaming market is set to be worth $45.5 billion in 2021.

Source : Fortunly

While the gaming industry’s growth prospects are undoubtedly astonishing, the competition to gain a piece of the revenue is intense, and consequently, less than 5% of all games produced each year become profitable.

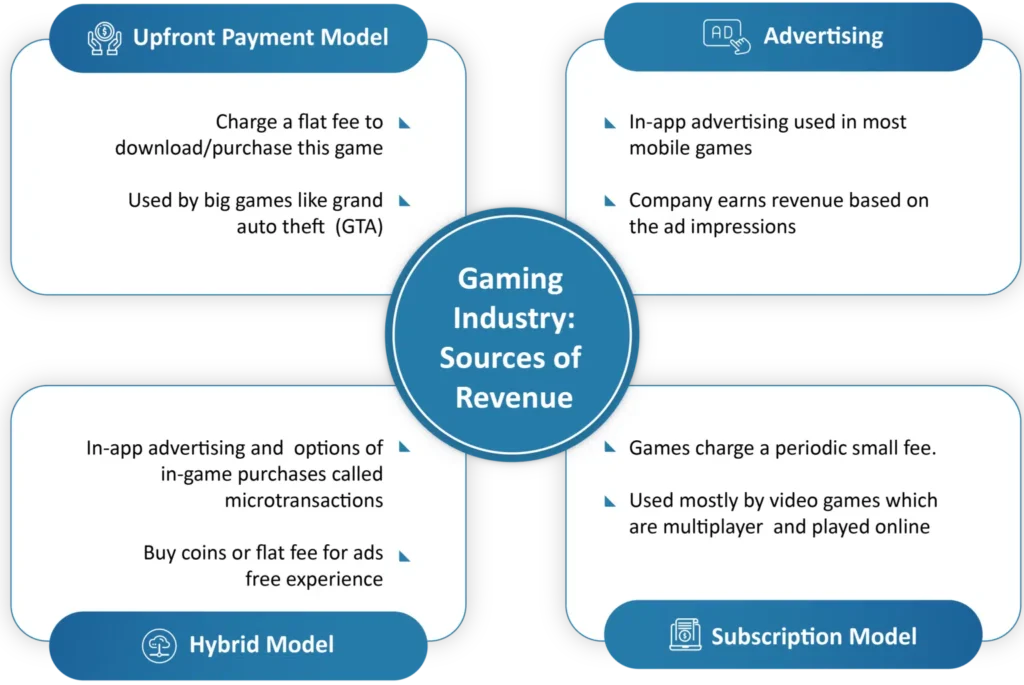

Gaming companies generate revenues through one of the above four models. For companies that use the upfront payment model, game publishers use services like XBOX Live, PlayStation Network, Steam, App Store, Google Play, etc, where people buy games. Revenues reach the company after commissions (in the form of a percentage of income) to these services.

But for most companies that use an advertising model, subscription model, or hybrid model, steady revenue generation is a challenge; many app downloads or players playing the game do not reflect the revenue success. Let’s understand how these companies acquire players and generate revenues.

Companies usually acquire players through advertisements on social networks (Facebook, Instagram, Snapchat, etc.), Search (Google, Apple, google play), or video networks.

Often, getting a new user to download an app and play a free mobile game costs a mobile gaming company around $4.37, but 87.7% of these new users never make an in-app purchase; thus, most new users/ players never contribute any revenues for the companies. So, the gaming companies must work hard to engage users and prompt them to make a first-time purchase. Engaging users with remarketing ads, freebies, etc cost the gaming companies an average of $35.42 before these new users create an in-app purchase to become a paying customer.

To generate profits, the gaming companies need first-time in-app purchase customers to make repeat purchases. Thus, a player needs to be retained for extended periods to ensure they become repeat purchase customers. Historically retaining players has been challenging for gaming companies as the games retention levels rarely surpass 50% on day one, 20% on day two, and by the end of the month, on day 30, the retention level is unlikely to exceed 5%.

For the players who are retained and do make an in-app purchase, there are some players who are exceptional in terms of revenues they generate for gaming companies. As pointed out by a Facebook study, 10% of the in-game purchasing players (“commonly called whales”) account for 90% of in-app sales, making them rare and unique for gaming companies.

The study further states that just 20% of all new players are ready to pay for playing a game. Thus, the competition for netting the “whales” is intense. As the number of games published increases, the competition is going to get even more intense. Thus, gaming companies will need to devise strategies to acquire new players, retain existing players, and turn them into profitable paying players/customers.

The primary challenge for gaming companies will continue to be balancing between spending on game development and marketing campaigns to acquire, retain and enhance the experience of whalers for repeat purchases.

Quality data management and analytics have the prima donna influence in aiding gaming companies to make critical business decisions by gaining better knowledge about the players and providing vital insights to marketing, game development, and design.

INTERESTING FACTS

- Every day, an online gaming service with a large user base creates approximately 50TB (terabytes) of gaming data. For example, Electronic Arts (EA) monthly playtime data includes roughly 50 billion minutes of gameplay from 2.5 billion gaming sessions.

Source: Strata Conference

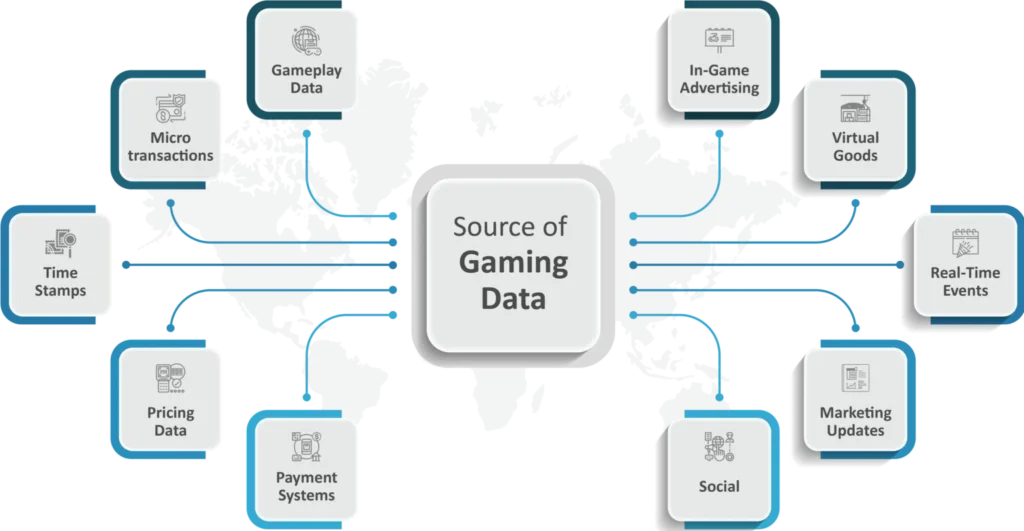

Let’s look at the various data sources for gaming companies and discuss some case studies that showcase how gaming companies can leverage data for business benefit.

The data generated from various sources such as marketing campaigns, gameplay microtransactions, social interactions, real-time events contribute to this massive surge in data.

An interesting consequence of the proliferation of data is that the first movers in the gaming industry pre-empt the need to look at external forces to determine the need to introduce new games or augment existing ones and elicit intelligence from existing & historical data.

Analysing data unravels information about players’ psychology, demographics, and behaviour, all of which can shore up business intelligence and decision-making.

Therefore, investing in the analysis of data can help gaming companies to:

- Identify trends

- Player preferences, periodicity, abandonment of levels & not opting for specific challenges, player persistence, and even geographical & cultural trends across regions

- Enhance customer experience through design alternatives not only on the UI but even ensuring fair play in a multi-player environment

- Optimise marketing campaigns

- Build effective strategies for increasing player acquisition and engagement

- Ensure compliance by proactively identifying and correcting system glitches (e.g., GDPR required that gaming companies need to provide players with information on data acquired & processed concerning them should a gamer request for details. GDPR also requires online gaming companies to ensure data security. In 2018, a German supervisory authority fined a local social gaming network for storing unencrypted user passwords. In addition to the looming fines, the potential reputational harm from data breaches maybe even more dangerous for game developers.)

- Improving revenue by analysing what and where a gamer spends more time & importantly what options they avoid & even which levels find frequent abandonment.

Benefits of Data Analysis for Gaming Companies

When ‘PeopleFun’ launched their game Wordscapes, they faced a challenge in converting free users to paying users and had to deal with low ARPPU (Average Revenue Per Paying User). The analytics indicated a broad player base, with a small number of players generating all the cash while most players could breeze through the game stages without assistance.

The company invested in detailed analytics of how the players were moving across the levels in the game. Based on this, they increased the difficulty curve, which improved paying customers as customers made more purchases to pass levels with increased difficulty.

The company did a similar analysis on the items being purchased by the players, and based on demand; they were able to make incremental changes in pricing for popular items. With this approach, they were able to realize an increase in in-app ARPDAU (Average Revenue per Daily Active User) from 2c to 10c, resulting 400% increase in daily game revenue. The revenue increase was re-invested to increase the monthly active user base from 10 thousand to 2 million while increasing the average transaction size from $2.20 to $4.10 (USD)

Data analysis can even help companies prevent disruption due to system errors and quickly react to system breakdowns.

For example:

With more than a million new installations per day, a mobile gaming company used to push special offers automatically and in-app cross-promotions across various channels.

These ongoing special offers and cross-promotions resulted in app purchases and hence were important for the company to achieve the revenue objectives. But a glitch during the mobile update resulted in the promotions and offers not being shown to users.

Thus, the company lost opportunities to cross-sell and upsell to new and existing players. As the company had over a million new installations each day, the system glitch and lack of promotions due to it resulted in more minor app purchases resulting in around 15% loss in revenue.

If the gaming company had used data to immediately track dip in-app purchases using automatic alerts or intuitive Business Intelligence dashboards, then this could have prevented the loss. Efficient and timely tracking of data around promotional metrics, installations, and revenue could have averted this revenue loss for the company.

Effective Data Engineering to Enable Data Analytics

We have seen how data analysis can enable gaming companies to attain business objectives. Still, complications begin to surface when they must process data about multiple events and combine it with other data like player payment/marketing data to get insights to uncover opportunities for revenue maximization.

It is challenging for gaming companies to collate the massive amount of varied data generated across different sources. Managing tedious data retrieval tasks like decompression, decryption, structure validation, error handling, auditing, etc., complicates data management.

In conjunction with a data analytics strategy, an effective data engineering strategy facilitates running, growing, and transforming the gaming business by ensuring clean, consistent, and reliable data. This, in turn, enables accurate analysis and more reliable decision-making, thereby improving gaming operations, mitigating compliance risk, reducing system breakdowns, and identifying new opportunities.

At Elait, we partner with gaming companies to create integrated data management solutions and applications that give comprehensive data views, enabling decision-making for providing a superior customer experience. Unleash your gaming data potential with Elait’s data solutions for the Gaming industry